Oil and Gas 2030 Meeting the growing demands for energy in the coming decades

Energy demand is expected to grow significantly in the next two decades, with increased demand mainly coming from emerging nations with increasing economic power. While governments and companies investigate alternative sources, for most regions of the world the biggest challenge will be learning how to better leverage technology to extract more oil and gas from existing sources, and find new ones.

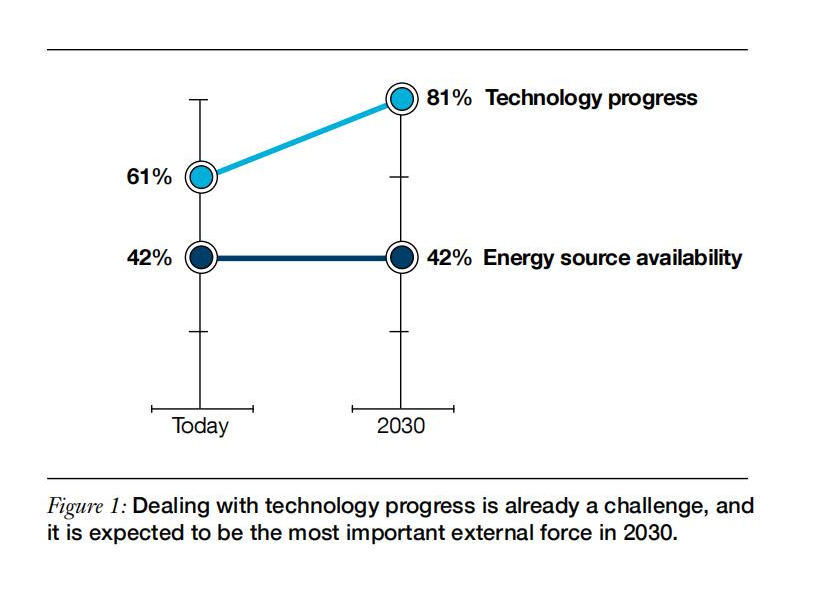

To better understand the future of the Oil and Gas industry, we interviewed more than 100 corporate level executives from different parts of the industry ecosystem. Because of the long investment cycle of the industry we looked two decades ahead to 2030. While 61 percent consider technology progress to be an important external force today, a full 81 percent expect it to be important in 2030 (see Figure 1). For the same period, 42 percent of respondents included energy source availability as one of the top five external forces. Interestingly, they anticipate it will carry the same importance – no more and certainly no less – in 2030 as it does today.

![]()

Not surprisingly, respondents readily acknowledged that there is always the risk of external events disrupting industry operations. Yet, respondents also stated that other industry trends are just as vital to plan for: the capabilities to operate in challenging frontiers, the need for a new skill mix, government impacts that are stricter and more diverse, and the evergrowing demand for hydrocarbon energy. In the shifting competitive field, national oil companies (NOCs) are becoming more dominant while the role of international oil companies (IOCs) is challenged due to energy source availability. New combinations of partnerships are forming as energy demand shifts to emerging markets.

Based on analysis of our study findings and the wide-ranging changes that are already impacting the industry, how can Oil and Gas companies act now to position themselves for success in 2030? The answer lies in leveraging strategic technologies to improve development of more challenging oil and gas resources, enhance recovery from existing fields, reduce environmental footprint and find new hydro carbon energy sources. Addressing each of these goals will depend on key success factors:

• Enhance performance management - Assess business units, partnerships, people, costs, assets and processes according to advance metrics and compared to peers.

• Manage enterprise-wide risk – Build governance to continuously identify and mitigate broad category of risks across organization and geographies.

• Focus on operational excellence – Architect value-adding activities reducing environmental impact, improving quality and enabling continuous cost improvements.

• Increase capacity through effective people management – Align the right people with the goals, processes, information and technologies to increase capacity and improve decisions

• Design adaptive business models – Integrate different types of business units, value chains, operating models, partnerships and technological disciplines.

Study demographics For the IBM Oil and Gas 2030 Study, we interviewed respondents in 28 countries, 60 percent of whom were from emerging markets including Brazil, Central and Eastern Europe, China, India, the Middle East, Russia and other parts of Asia (see Figure 2). By industry, more than three-fifths of our respondents were Oil and Gas producers and Service providers. The following categories each represented roughly another 10 percent of the remaining respondents: Analysts and Research; the Power, Transportation and Chemicals industries; and Government regulators/influencers in key energy nations.